Nicosia – The Cyprus Tax Department presented to members of the Cyprus VAT Association (CYVA) the new Tax For All (TFA) platform, earlier today.

During a one-hour Zoom meeting, Anna Fantarou, Principal Assessor and External Communication Manager/Change Agent at the Central Offices of the Ministry of Finance and Nikolas Pavlou, Project Manager of the Integrated Tax Administration System (ITAS), offered CYVA members a first glimpse into the new system that is set to replace the existing tax platforms, including TAXISnet, starting before the end of the year.

Anna Fantarou claimed that the new system will be “better, simpler, more secure and more transparent” than the previous one, adding:

“With the new system, tax payers will be offered a more integrated picture of their tax affairs.”

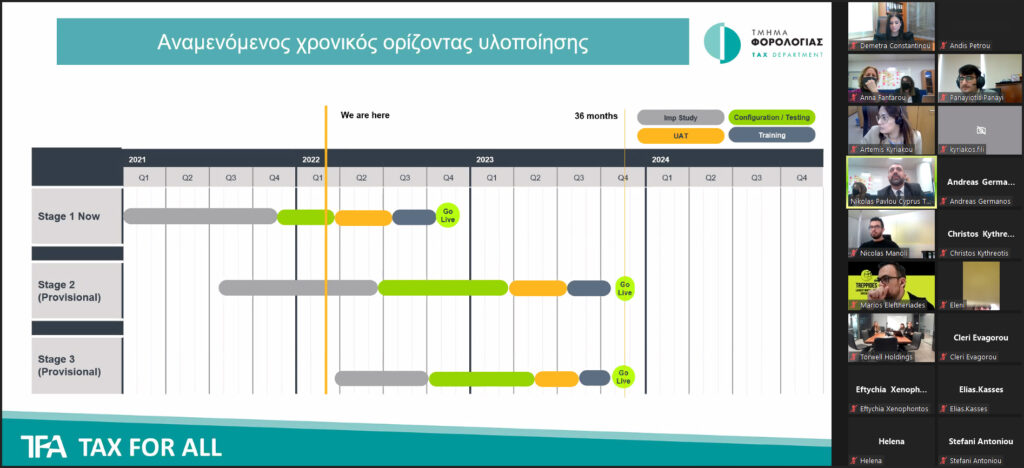

Nikolas Pavlou explained that the new online platform is being developed in three stages. The first stage deals solely with Value Added Tax (VAT) and will be released in November 2022. The remaining two stages, which will handle direct and other taxes are planned to be released by the end of 2023.

CYVA regularly organises VAT-specific educational events and presentations either on its own or in cooperation with government agencies, local professional bodies and associations.

CYVA was established in 2019 with the aim of providing a unified and independent voice to all professionals and businesses in Cyprus on VAT matters.

Members of CYVA include Cyprus businesses such as law, accounting and audit firms, corporate and administrative services companies, local and international business companies, as well as self-employed persons.