Nicosia – A new VAT law has been published in the Government Gazette changing, among other things, VAT returns and payments to monthly for certain taxable persons.

The specific businesses that are being affected have been notified by the Tax Department (TD) through the email they have provided to TAXISnet.

The relevant notification, as well, as the decree ΚΔΠ170/2020 provide for the following:

- Change of the duration of the VAT returns.

- Change of the deadline for submission of the relevant VAT returns to the 27th day following the end of each reporting period.

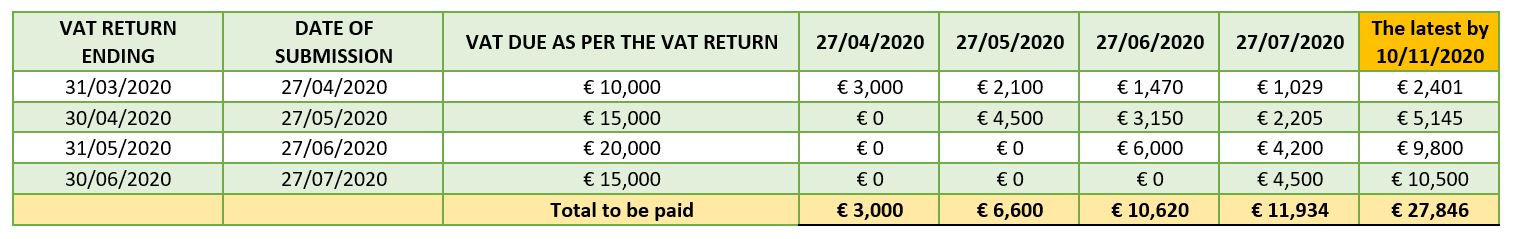

- Partial VAT payment for some businesses by enabling them to only discharge 30% of the total VAT due as at the date of submission of each VAT return (i.e. 30% of the VAT due as per the current VAT return + 30% of the VAT due referring to previous VAT returns).

To assist with the interpretation of the law the TD followed up with a notification giving some more guidance on this new law which is attached herein for your reference.

Below is a tabular illustration of an example for a better understanding:

We draw your attention to the fact that affected businesses will have received an email at the address they have lodged with Taxisnet so please make sure you check that email address and act swiftly if you have received such an email to ensure you manage your liquidity.

CYVA is at your disposal should you need any further information or clarifications.