Nicosia – Further to our previous correspondence regarding monthly VAT returns and payments, on 21 April 2020 the Tax Department (TD) issued a clarification notification as follows.

Taxable persons:

- who have been notified that their VAT returns are switched from quarterly to monthly, and

- whose tax return ended on 29/2/2020 and was submitted on 10/4/2020, and

- who deferred payment of the VAT until 10/11/2020 (as allowed by law N.24(I)/2020),

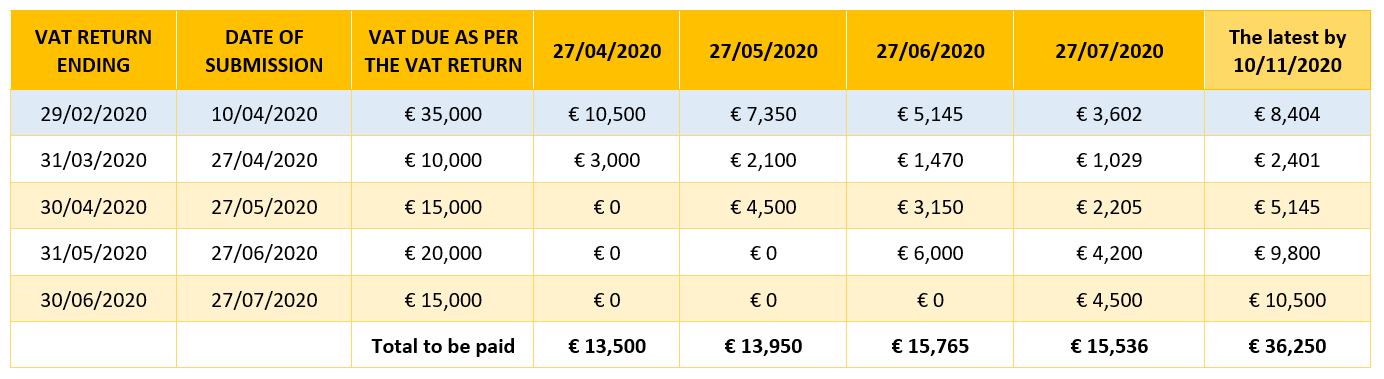

have to include this deferred (and unpaid) VAT amount in the calculations of the VAT due when determining their monthly VAT payments as per the Regulatory Administrative Act 170/2020 (Κ.Δ.Π 170/2020) due on the 27th of each month starting from the 27/04/2020 and ending on the 27/07/2020, with the balance being payable by 10/11/2020 as per Law 24(I)/2020.

Herein, you may find our previous example amended with the addition of the first line (highlighted in blue) reflecting how the VAT due must be paid in the case that the company is included in the ones notified by the tax office that their tax returns are switched from quarterly to monthly. As illustrated below, the relevant companies are not anymore eligible for the suspension of the full VAT payment until 10/11/2020. Instead, they have to be discharging 30% of their total VAT liability on the 27th of each month starting from the 27/04/2020 and ending on the 27/07/2020, with the rest being payable by 10/11/2020 as per Law 24(I)/2020. A reminder that if the company is in the published table they are required to pay their full VAT with each monthly VAT return.

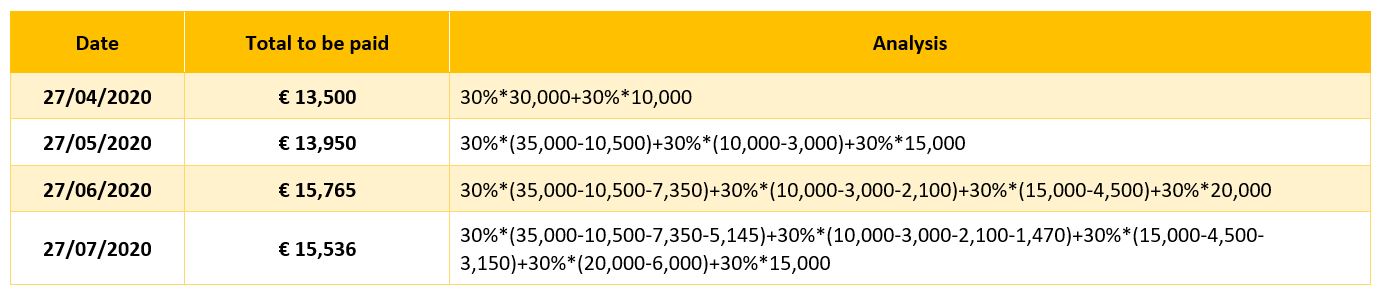

Also, below you may find the analysis of the amounts included in the above table for better understanding.

The TAXISnet system of the affected taxable persons has already been updated so if your VAT return ended 29/02/2020 you will notice that your TAXISnet now shows a monthly VAT return for March. Although TAXISnet may have the submission date as 10/05/2020 for the monthly VAT return of March please ignore that as it is a system error.

Taxable persons which have been switched to monthly VAT returns are obligated to submit them by the 27th of the following month regardless of the submission dated indicated in TAXISnet and this is made clear in the relevant notification email sent by TAXISnet to such taxable persons.